About the property

Lodgian is a publicly-traded (AMX:LGN) owned and operated a portfolio of 27 hotels ($200 million in revenues and 5,231 rooms) with various Marriott, Hilton, IHG and Starwood brands.

Stratford’s Role & Responsibilities

Dana identified Lodgian’s hidden asset value, sourced this investment opportunity and raised $142 million from a private equity firm to take LGN private, becoming one of the 20 largest private US hotel owners, and rescuing LGN from another probable bankruptcy. He negotiated $270+ million merger at a 67%+ share price premium, including assumed debt, and negotiated the purchase of a $130 million Goldman Sachs mortgage at a significant 27% discount as a predecessor transaction. He then sold 15 LGN hotels with 2,768 rooms ($255 million which was above our year-five underwritten exit value) in 16 months, at a 6.6% T12 cap rate and paid off $224 million of debt. He personally sourced buyers for 40% of the portfolio.

-

Re-focused LGN from operations to real estate ownership and asset management as its core competency. Hired a new corporate team, developed its culture, downsized the corporate office from 43 to 7 people and reduced $12.5 million of corporate overhead cost to less than $2 million without losing any key employees. Evaluated almost two-dozen management companies; structured and negotiated management contracts with six management companies to align interests and achieve results.

-

Capitalized on strong franchise relationships as evidenced by achieving better-than-market terms including: key money, reduced royalty fees (transferable), same PIP for a subsequent buyer, conversion before (reduced scope) renovations completed, and various low or no cost extensions.

-

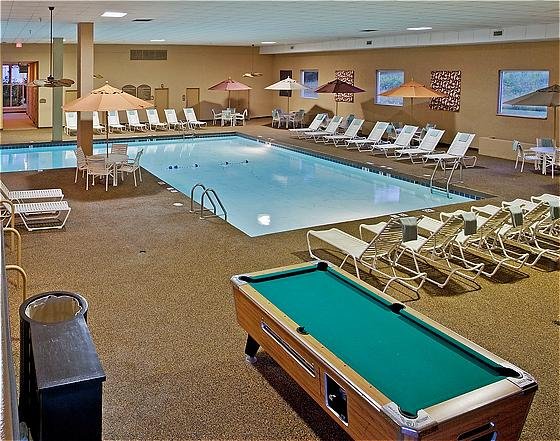

Created value by repositioning, up-branding and converting six hotels from Radisson, Wyndham, Holiday Inn and Crowne Plaza to Doubletree, Hilton and Embassy Suites.

-

On time and $2.9 million under $15 million budget for 11 substantial, cost-effective renovation projects that focused on “big bang” results. Developed new Capex project management budgeting, reporting and tracking process, templates, contracts and RFP’s to improve information, control and lender reimbursement efficiency.

-

Continually evaluated operating and financial performance (“what gets measured, gets done” accountability) and recommended operational re-engineering. Liaison with management to direct focus to best practices thereby increasing performance and NOI margins at an efficient capital cost. Changed sales mix, improved revenue management (PPC, SEO, GDS, BAR, opaque, discount) strategy and expanded marketing efforts.

-

Completely changed a majority of the hotel’s executive committees, filled many vacancies, developed manager and executive committee strength, replaced regionals and eliminated staff layers. Transitioned 3,239 employees to new employer, achieved favorable results at two union negotiations, instituted new insurance plans and terminated the 401k plan.

-

Oversaw the firm’s financial and treasury reporting, fund and investor accounting, cash management and forecasting, converted from public company accounting to private, converted accounting software systems, changed tax counsel and reduced taxes. Handled a high volume of due diligence; equity dispositions, dissolutions and receiverships; debt refinances, renegotiations, payoffs and unwinding of pooled-loan cash management structures. Managed 16 SPE REITs and TRS’s, including de-REITing two assets. Restructured REIT leases to maximize tax savings and maintain REIT compliance.

-

Improved IT by replacing Oracle ERP system and seven-person IT department with low-cost server, accounting, payroll, email, website, and phone systems.

Location

Various locations in the U.S.

Returns

49% IRR

$150 Million

Operating Results

As LGN’s 8th CEO/President in 10 years, Dana led a turnaround at this troubled company by improving same-store Net Operating Income almost 10% in first full year (2011); despite a 10% increase in aggregate competitive supply and disruptions from: brand and e-commerce changes, renovations and the disposition process (buyer tours, due diligence, personnel relocations, hiring obstacles, reduced management focus).

Last quarter as CEO/President (1Q12), Net Operating Income increased 33% above prior year.

The Stratford Advantage

With decades long, hospitality-industry relationships, Dana was able to provide superior preemptive access to non-auction investment options and therefore better pricing. A focused, disciplined, data-driven risk assessment and pricing approach tapped the opportunity created by inefficient, cyclical markets to acquire at a bargain price relative to future value and provide a margin of safety. This Lodgian investment arbitraged a heterogeneous portfolio discount by buying wholesale and selling retail and was restructured and turned around in a year with better business plans and execution. Valuation, trend and timing informational advantages improved risk-adjusted returns.